Quotes & Sayings About Bear Markets

Enjoy reading and share 18 famous quotes about Bear Markets with everyone.

Top Bear Markets Quotes

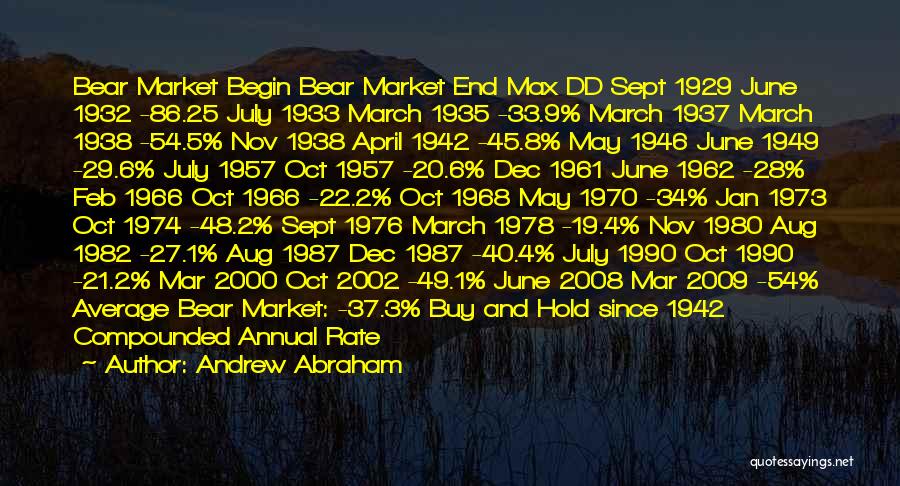

Bear Market Begin Bear Market End Max DD Sept 1929 June 1932 -86.25 July 1933 March 1935 -33.9% March 1937 March 1938 -54.5% Nov 1938 April 1942 -45.8% May 1946 June 1949 -29.6% July 1957 Oct 1957 -20.6% Dec 1961 June 1962 -28% Feb 1966 Oct 1966 -22.2% Oct 1968 May 1970 -34% Jan 1973 Oct 1974 -48.2% Sept 1976 March 1978 -19.4% Nov 1980 Aug 1982 -27.1% Aug 1987 Dec 1987 -40.4% July 1990 Oct 1990 -21.2% Mar 2000 Oct 2002 -49.1% June 2008 Mar 2009 -54% Average Bear Market: -37.3% Buy and Hold since 1942 Compounded Annual Rate of Return: 8.03% Maximum Draw down: 54% Prior to this decade's two severe bear markets, most investors believed that only that the stock market can go up. — Andrew Abraham

Bear markets are like bad colds. You hate them, but you know eventually you'll feel better. — Marvin H. McIntyre

During bull markets, everyone believes that he is committed to stocks for the long term. Unfortunately, history also tells us that during bear markets, you can hardly give stocks away. Most investors are simply not capable of withstanding the vicissitudes of an all-stock investment strategy. The — William J. Bernstein

The bubble, as investing phenomenon, has been well studied ever since the 17th-century tulip bulb frenzy. Its counterpart in bear markets is not well understood. — Kenneth Fisher

Value #1: Reality Huh? Isn't every business based on reality? In fact, isn't everything based on reality? Actually, no. Lehman Brothers, Bear Stearns, AIG (American International Group), IndyMac, Washington Mutual, Countrywide, and all the other banks that blew themselves to smithereens in 2008 weren't basing their businesses on reality. They were basing their businesses on sheer fantasy, wish, and whim - and an unhealthy dose of greed, the most unrealistic thing of all. They believed the housing market would always go up. Credit markets would never be illiquid. People with no jobs could pay back their mortgages. — Donald Luskin

There will always be bull markets followed by bear markets followed by bull markets — John Templeton

The starting point of my career in money management in 1973-74 was the time of the only true bear market any living non-Japanese investor has seen in major markets. Equities, real estate, you name it, everyone got run over. — Paul Singer

In falling markets, there is nothing that has not happened before. The bear or pessimist sees only the past, which imprisons the wretched financial soul in eternal circles of boom and bust and boom again. — James Buchan

Secular cycles are the long periods - as long as decades - that come to define each market era. These cycles alternate between long-term bull and bear markets. — Barry Ritholtz

The reality is that the American people have no desire for an empire. This is not to say that they don't want the benefits, both economic and strategic. It simply means that they don't want to pay the price. Economically, Americans want the growth potential of open markets but not the pains. Politically, they want to have an enormous influence, but not the resentment of the world. Military, they want to be protected from dangers but not to bear the burdens of long-term strategy. — George Friedman

There is no "good," just passages and pathways to greater depths of pain brought to bear as markets diversify and specialise. In thinking he is winning - be it through miraculous medical advancements, enlightened self-interest which fosters a degree of social stability, or a planet wide agricultural revolution - man is in fact throwing himself into heightened states of artfully dressed turmoil: mayhem which could only thrill a Creator disposed to being thrilled at such sweet turbulences. — John Zande

The new structure of the U.S. stock market had removed the big Wall Street banks from their historic, lucrative role as intermediary. At the same time it created, for any big bank, some unpleasant risks: that the customer would somehow figure out what was happening to his stock market orders. And that the technology might somehow go wrong. If the markets collapsed, or if another flash crash occurred, the high-frequency traders would not take 85 percent of the blame, or bear 85 percent of the costs of the inevitable lawsuits. The banks would bear the lion's share of the blame and the costs. The relationship of the big Wall Street banks to the high-frequency traders, when you thought about it, was a bit like the relationship of the entire society to the big Wall — Michael Lewis

Bull markets and Bear markets can obscure mathematical laws, they cannot repeal them. — Warren Buffett

The virtue of female slaves is wholly at the mercy of irresponsible tyrants, and women are bought and sold in our slave markets, to gratify the brutal lust of those who bear the name of Christians. — Sarah Moore Grimke

For all its celebration of markets and individual initiative, this alliance of government and finance often produces results that bear a striking resemblance to the worst excesses of bureaucratization in the former Soviet Union or former colonial backwaters of the Global South. There is a rich anthropological literature, for instance, on the cult of certificates, licenses, and diplomas in the former colonial world. Often the argument is that in countries like Bangladesh, Trinidad, or Cameroon, which hover between the stifling legacy of colonial domination and their own magical traditions, official credentials are seen as a kind of material fetish - magical objects conveying power in their own right, entirely apart from the real knowledge, experience, or training they're supposed to represent. But since the eighties, the real explosion of credentialism has been in what are supposedly the most "advanced" economies, like the United States, Great Britain, or Canada. — David Graeber

The longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear markets are possible. — Benjamin Graham

Motive Waves There are two types of Motive Waves: Impulse Waves and Diagonal Triangles. Impulse Waves The basic characteristics of Impulse Waves are as follows: 1. Wave 2 never retraces (corrects) more than 100% of Wave 1. 2. Most of the times Wave 3 is the longest wave in the 5 Wave series but is never the shortest. 3. Wave 4 never overlaps Wave 1. 4. Wave 2 and Wave 4 always alternate i.e., if Wave 2 is a zigzag, Wave 4 will be a complex correction and vice-versa. 5. Wave 4 retraces atleast until the end of fourth wave of lower degree. 6. Impulse waves occur within parallel trend channels i.e. when we connect the ends of wave 2 and 4, and draw a line parallel to it from the end of wave 3, Wave 5 can be expected to end at the upper trend line. 7. Impulse Wave formations during bull and bear markets are as shown in Figures below. — Jasjeet Kaur

Since the soon-to-be outnumber the living; since the living have greater impact on the unborn than ever before thanks to depletion of natural systems, atmospheric disruption, toxic residue, burgeoning technology, global markets, genetic engineering, and sheer population numbers; since our scientific and historic understandings now comfortably examine processes embracing eons; and now that our plan-ahead horizon has shrunk to five years or less - it would seem that a grave disconnect is in progress. Our everhastier decisions and actions do not respond to our long-term understanding, or to the gravity of responsibility we bear. "The — Stewart Brand